About Unbeatable Loans

Founding Unbeatable Loans

John Pastre started Unbeatable Loans after he helped his fourteenth client buy a house without a realtor. The hardest parts about finding a home isn't finding a house, it's getting into the property and writing a contract. Of course, buyers also face struggles finding financing, and a home purchase never gets off the ground without a mortgage lender.

This pain point, when you find the house online and need to scramble, is the problem Unbeatable Loans is designed to solve.

On top of this scramble, John realized that the mortgage industry lacked technology for mortgage brokers to advise on purchase offers from a place of confidence. The truth is most brokers are trained to input data into software and wait for approvals.

So instead of continuing to sit on his hands and wait for more clients to struggle through the pain point of finding a dream house, John built Unbeatable Loans—a platform designed to give real estate buyers the kind of savings, mortgage insight, offer generation capability, and deal analysis they can’t find anywhere else, and especially not from your average real estate agent.

At Unbeatable Loans, whether it’s helping a client buy their first home or working with a seasoned investor refinancing a portfolio across three states, my focus is the same: give the client the best purchase experience possible.

At Unbeatable Loans, we look to build long-term real estate knowledge for people building wealth through real estate now or in 5 years. We believe an unbeatable deal makes the difference for real estate investors and home shoppers.

The Unbeatable Loans Technology

Unbeatable Loans started as a solution for creating loan estimates.

Instead of having to create an application for each property, which is how traditional loan origination systems work, Unbeatable Loans is designed to allow you to compare multiple opportunities at one time.

I have worked with all sorts of technology in the lending space. They rely on third party applications to get data. We are entirely algorithm based. We are not reliant on any other technology. We know what it costs to buy a home because we have helped hundreds of clients BUY A HOME. We are not just a tech company. We are not just a mortgage company. We are a home buying company.

That experience led directly to the founding of Unbeatable Loans—a platform designed to give real estate buyers the kind of mortgage insight, offer generation capability, and deal analysis they can’t find anywhere else, not even from a real estate agent.

At Unbeatable Loans, whether it’s helping a client buy their first home or working with a seasoned investor refinancing a portfolio across three states, my focus is the same: give the client the best purchase experience possible.

At Unbeatable Loans, we look to build long-term real estate knowledge for people building wealth through real estate. We believe an unbeatable deal makes the difference for real estate investors and home shoppers.

Cutting out the Agent and Brokering Mortgages – The Unbeatable Solution

In my pursuit to help my clients get the best rates and keep costs low, brokering loans to lenders is a better option rather than funding them as a mortgage lender.

By staying a mortgage broker rather than becoming a mortgage lender, I can provide mortgages at wholesale rates, saving investors money on origination costs, and keeping my focus on providing the best purchase experience at scale.

As a broker, I have the freedom to offer hundreds or even thousands of different loan structures specifically designed for every particular scenario.

On top of primary and secondary residence mortgages, we are known for crafting deals that align with investment logic. At Unbeatable, we work closely with clients purchasing their first home, buying multiple units, forming LLCs, navigating DSCR guidelines, or seeking better long-term leverage.

See My Recent Blog Posts

Questions to boost your Mortgage Savings

Wondering where to start with questions about your current mortgage or getting the best purchase mortgage? ...more

Mortgage

November 17, 2025•6 min read

Market Update: Veterans Day 2025

The housing market is finally reaching that sweet spot investors and buyers have been waiting for – equilibrium. ...more

Market Updates

November 11, 2025•5 min read

October Rental Investor Market Update

The fed rate cut combined with larger uncertainty than priced into the stock market is starting to create waves in mortgage rates. ...more

Market Updates

October 30, 2025•5 min read

Insurance in the Mortgage Process

The mortgage process isn't easy, and insurance is one of the most important, often overlooked as easy, parts of the process. ...more

Mortgage

October 21, 2025•6 min read

What to put in a Rental and Lease Agreement

Wondering what to include in a lease? Tempted to skip the long lease and just trust your tenant? Read this article before you lose your rights as a landlord. ...more

Investors

October 08, 2025•7 min read

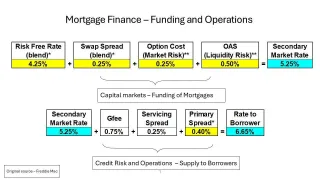

Technical: Where Mortgage Rates Come From

Mortgage rates adjust daily, but ever wonder why the market acts so efficiently and how lenders choose what rate to charge? ...more

Mortgage ,Market Updates

October 08, 2025•5 min read

Thank you for choosing Unbeatable Loans. We are dedicated to helping you achieve your homeownership goals with personalized service and expert guidance. For more information or assistance, feel free to reach out to our team anytime.

quick info

813 SW 16th CT, Fort Lauderdale, FL 33315

954-466-1614